1. Understanding the NinjaTrader Platform

Understanding the ins-and-outs of the NinjaTrader platform is essential before exploring its alternatives. Built largely with futures and forex traders in mind, NinjaTrader is a robust platform that offers advanced analytics, trade simulation, and more. It integrates with several data sources and brokers, allowing users to manage their trades and market analysis in one place.

The core component of NinjaTrader is its unique trade management system. This system enables users to pre-define personal trade strategies through stop-loss and profit-target orders, essentially automating the trading process. This feature is particularly attractive to those who want to minimize emotional decisions and stick to a disciplined trading approach.

Another noteworthy feature is NinjaTrader’s market analyser. It allows traders to monitor and find potential trade setups quickly. The analyser provides a customizable, real-time quote sheet that simplifies the process of tracking favored markets.

NinjaTrader also offers a host of charting capabilities. It includes more than 100 pre-built customizable indicators, as well as the option to create one’s own. These charting tools enable traders to visualize market trends and make informed decisions.

NinjaScript, a C#-based language, allows users to design their own automated strategies and custom indicators. It’s a powerful tool but requires a degree of programming knowledge. For those who don’t have this knowledge, NinjaTrader has a thriving community where users can share or sell their custom scripts.

NinjaTrader’s backtesting feature is another highlight. Traders can use it to test their trading strategies against historical data to ascertain their effectiveness. This feature allows traders to refine and perfect their strategies before putting them to use in the real market.

For traders who are just starting out, NinjaTrader offers a free version with limited features. It includes basic charting, simulated trading, and trade management capabilities. However, to access features like advanced charting, market analysis, automated strategy development, and more, traders must upgrade to the paid version.

Despite its many blessings, NinjaTrader may not suit every trader. The platform focuses on futures and forex markets, so those trading primarily in options and stocks might find it lacks certain features. Additionally, its interface can seem intimidating to beginners due to its complexity. For those who don’t trade full-time, the cost of the paid version may be prohibitive.

Evaluating NinjaTrader in these terms gives us a solid understanding of its strengths and weaknesses. This understanding can help us explore and compare NinjaTrader alternatives more effectively.

1.1. Overview of NinjaTrader

NinjaTrader is a leading trading platform that provides advanced charting tools, trade simulations, strategy backtesting, and live trading features for futures, forex, and equities. Given its comprehensive features and flexibility, NinjaTrader is often the go-to choice for both beginner and experienced traders. Traders appreciate the platform’s customizability, which allows them to tweak and adjust the layout to suit their specific needs.

Beyond charting and execution, one of the unique selling points of NinjaTrader is its advanced analytical capabilities. It boasts a suite of market analytics tools that allow traders to conduct in-depth market analysis to help them make informed trading decisions. This includes advanced charting, market analytics, automated strategy development, and trade simulation. All these features are designed to help traders analyze market trends, identify potential investment opportunities, and manage their trading risk.

Automated trading is another highlight feature of NinjaTrader. The platform offers an automated trading solution that enables traders to design, backtest, and deploy their own automated trading strategies using NinjaScript, NinjaTrader’s proprietary programming language. The automated trading feature is particularly useful for traders who have specific trading strategies that they would like to automate, freeing them from having to manually monitor and execute trades.

Another appealing aspect of NinjaTrader is its pricing structure. The platform offers a free-to-use version, known as NinjaTrader Free Edition, that comes with basic functionalities such as advanced charting, market analytics, and trade simulation. For traders seeking more advanced functionalities like live trading and premium support, NinjaTrader offers a Lease or Lifetime license at a reasonable cost. The flexible pricing structure allows traders to choose the version that best fits their trading needs and budget.

However, despite its many advantages, NinjaTrader does have its limitations. For one, its steep learning curve can be challenging for novice traders. Additionally, the platform is primarily designed for futures and forex trading, making it less ideal for traders focusing solely on equities. Its dependence on Windows OS also limits its accessibility for Mac or Linux users.

As such, while NinjaTrader offers a comprehensive suite of trading tools and capabilities, it may not be the perfect fit for everyone. Traders should consider their specific needs, trading expertise, and financial resources when deciding whether NinjaTrader or an alternative trading platform is the right choice for them.

1.2. Features of NinjaTrader

The NinjaTrader is a robust trading platform that offers a wealth of features designed to cater to both beginner and experienced traders alike. One of its most highly prized features is its advanced charting capabilities. These provide extensive options for technical analysis with a myriad of chart styles, including OHLC, Line, Point & Figure, and Renko, as well as over 100 built-in indicators and tools for custom indicators. Traders have the ability to effectively track and analyze multiple markets simultaneously with the multi-threading strategy performance feature.

NinjaTrader’s trade simulation feature is another noteworthy aspect. It offers a realistic simulation environment where one can test their trading strategies using historical market data, without risking real money. This can prove invaluable for beginners looking to gain experience and seasoned traders testing new strategies. The platform further provides automated trading capabilities through its NinjaScript programming language, allowing traders to create their strategies and implement them autonomously.

In terms of order execution, NinjaTrader offers Advanced Trade Management (ATM) capabilities that provide predefined strategies for stop losses and profit targets. This feature allows traders to manage their orders efficiently and maintain better control over potential losses. Additionally, the platform also supports Direct Market Access (DMA), enabling traders to directly trade with market liquidity pools, leading to potentially better pricing and faster trades.

One unique aspect of NinjaTrader is its Market Replay feature, which allows traders to replay, pause, rewind and fast-forward trading sessions to analyze the market at their own pace, akin to a financial time machine. The platform also supports spread trading, a more advanced approach that allows trading on the price difference between two or more financial instruments.

Lastly, NinjaTrader offers a comprehensive development environment replete with a wide array of powerful features. This includes access to the NinjaScript Editor for script development, debugging, and back-testing, as well as a Strategy Analyzer for detailed performance reports. This makes NinjaTrader a compelling choice for traders who wish to hone their strategies and increase their trading prowess.

1.3. Limitations of NinjaTrader

While NinjaTrader is widely recognized for its comprehensive features and advanced charting capabilities, it’s important to consider certain inherent limitations that may affect your overall trading experience. One of the main drawbacks is its limited broker support. Unlike some of its competitors, NinjaTrader’s platform is limited to a select few brokerage services. This can be restrictive for traders who may prefer using different brokers due to their unique offerings, lower fees, or better customer service.

Another limitation is the complexity of the platform. While its comprehensive features are advantageous for experienced traders, beginners may find the platform overwhelming and difficult to navigate. The steep learning curve involved may deter novice traders seeking more straightforward, user-friendly alternatives.

Resource consumption is another area of concern. NinjaTrader is known for consuming significant computer resources, which can often lead to slower processing speeds, especially on less powerful machines. This could potentially impact real-time trading where speed and accuracy are key.

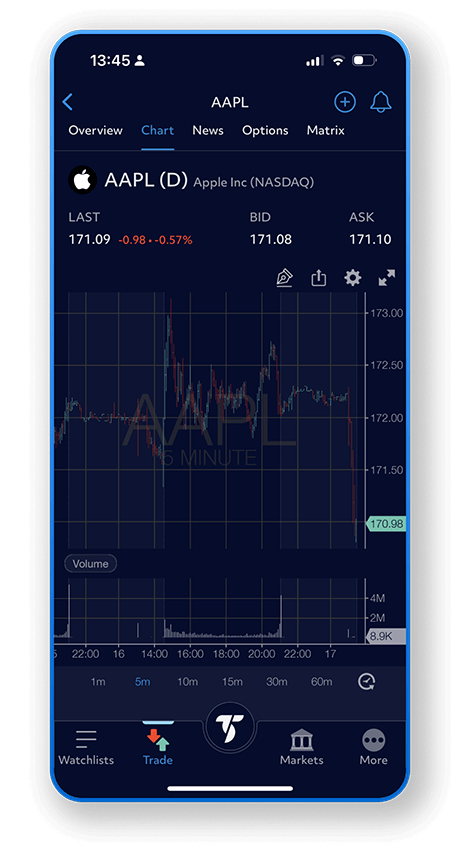

The platform also lacks native mobile applications. In this digital age where trading on-the-go is becoming increasingly popular, the absence of a dedicated app can be a significant drawback for many traders.

Lastly, while NinjaTrader does offer a free version of its platform, it comes with restricted functionalities. To unlock all features, you need to purchase a lifetime license or lease the platform on a quarterly, semi-annual, or annual basis. This pricing model may not be cost-effective for all traders, particularly those just starting out or those trading on a smaller scale.

Consideration of these factors is crucial when evaluating whether NinjaTrader suits your trading needs, or if seeking alternative platforms might be a better decision. Remember, the optimal trading platform is largely dependent on individual needs and preferences, including your experience level, trading style, and financial capacity.

2. Major Alternatives to NinjaTrader

When discussing alternatives to NinjaTrader, one cannot ignore the powerful capabilities of Metatrader 4 (MT4) and TradeStation.

Metatrader 4 is a popular trading platform recognized for its accessibility, ease of use, and wide range of tools. It supports multiple order types, including Market, Limit, Stop, and Trailing Stop, and offers automated trading through the use of the popular Expert Advisors (EAs) functionality. This feature allows users to create, customize, and utilize automated trading strategies, freeing them from the need to constantly monitor the market. MT4 also has a large, vibrant online community, where traders can share experiences, strategies, and tools, making it an excellent resource for both novice and experienced traders.

Additionally, MT4 offers a comprehensive suite of charting tools, with over 30 built-in technical indicators and 24 analytical objects. It also supports the creation of custom indicators and scripts via the MQL4 language, allowing traders to fully tailor their trading experience to their individual needs. The platform also provides real-time financial news and alerts, keeping traders informed of market-moving events. MT4 is compatible with a wide range of devices, including Windows, Mac, and Linux computers, as well as Android and iOS mobile devices, ensuring that traders can monitor and manage their trades from anywhere, at any time.

On the other hand, TradeStation is another commendable alternative that features powerful trading and analysis tools. One of its key strengths is its proprietary TradeStation coding language, EasyLanguage, which allows users to create and backtest custom trading strategies and indicators. Advanced order capabilities, including OCO (One Cancels Other), bracket orders, and trailing stops, facilitate sophisticated trading strategies.

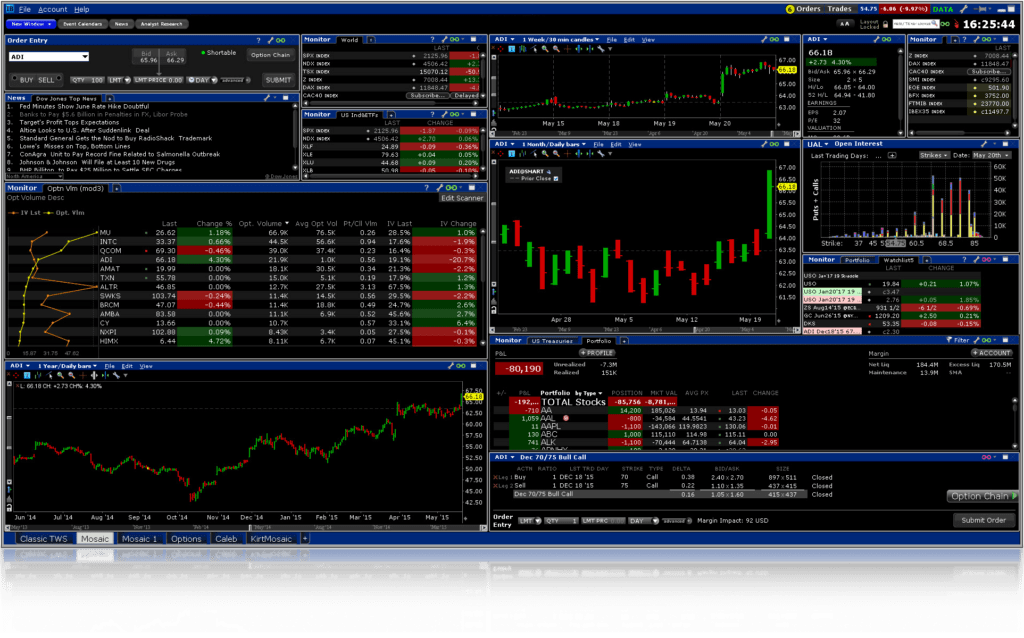

TradeStation also has a robust charting package, with a wide array of chart types, over 80 technical indicators, and numerous drawing tools. The RadarScreen tool provides real-time market scanning and ranking, helping traders identify trading opportunities. Moreover, the platform’s Matrix feature combines the benefits of a detailed market depth window, a highly advanced order entry tool, and a precise order tracking system into one single, comprehensive interface. Like MT4, TradeStation also facilitates automated trading, with users able to backtest, optimize, and automate their strategies. This platform is also highly customizable, allowing users to modify the look, feel, and functionality to match their trading style and preferences. TradeStation is available on desktop, web, and mobile platforms, providing traders with the flexibility to stay connected to the markets at their convenience.

Each of these alternatives brings its unique strengths and functionalities, providing a comprehensive and versatile platform for traders of all experience levels. Whether you value intuitive user interface, sophisticated trading tools, comprehensive charting capabilities, or a vibrant online community, both Metatrader 4 and TradeStation offer compelling alternatives to NinjaTrader.

2.1. MetaTrader 4 and 5

When it comes to alternatives to the NinjaTrader platform, the MetaTrader 4 and 5 undoubtedly take center stage. Both are hailed as robust and versatile trading platforms that cater to a wide range of users, from novice traders to seasoned professionals. MetaTrader 4 (MT4) offers a user-friendly interface for forex trading and technical analysis. It supports multiple languages, making it a global platform. Its features include a built-in language for programming trading strategies, enabling users to develop their own custom indicators and scripts.

In addition, MT4 provides a wide range of technical analysis tools, including over 30 built-in technical indicators and 24 graphical objects for comprehensive analysis of currency pairs and other financial instruments. Furthermore, it includes advanced features, such as the ability to handle a vast number of orders, various types of execution modes, and different timeframes for trading. It also allows traders to monitor the forex market in real-time and respond instantly to any changes.

MetaTrader 5 (MT5), on the other hand, is considered a more advanced version of MT4. It is not just limited to forex trading but is also suitable for trading other assets, including stocks and futures. MT5 offers more technical indicators, graphical objects, and timeframes than MT4. It also provides a more advanced integrated development environment for Expert Advisors— the automated trading systems designed to implement and facilitate Forex trading strategies.

Another notable feature of MT5 is its depth of market (DOM) feature, which provides a clear view of market liquidity, allowing traders to see available volumes at different market prices. As such, MT5 is preferred by traders who require a broader view of the markets and more advanced features for their trading strategies.

Both MetaTrader 4 and 5 offer mobile applications, enabling traders to monitor their positions and execute trades from their smartphones and tablets. They also support automated trading and provide a host of tools for backtesting trading strategies.

Overall, MetaTrader 4 and 5 are not just alternatives to NinjaTrader; they are powerful trading platforms that provide valuable tools and features to enhance trading experience and efficiency. Whether you are a beginner or an experienced trader, both platforms cater to your needs and evolving trading strategies.

2.2. TradeStation

If you’re looking for a platform that is robust and user-friendly, TradeStation may be the perfect fit. This platform is rich in features that cater to both beginner and experienced traders. One of its most notable features is its highly customizable charts. These charts are more than just visual representations of market data; they allow users to draw, annotate, and even back-test strategies. A trader can overlay multiple indicators onto a single chart, providing a comprehensive view of market trends and patterns.

TradeStation also offers an impressive array of order types, including stop, limit, and conditional orders, among others. This ensures that traders have all the necessary tools to enter or exit the market at the most optimal points. Additionally, this platform supports automated trading. Users can create, backtest, and implement their own trading algorithms, a feature which is particularly useful for systematic traders.

TradeStation’s mobile app is another key highlight. It offers nearly all the functionalities of the desktop platform, meaning you can trade on the go without missing out on important features. The app is available on both iOS and Android, making it accessible to a wide range of users.

Beyond its impressive set of features, TradeStation is also known for its competitive pricing. The platform offers multiple pricing plans to cater to different trading styles and volumes. This includes a per-trade plan, a per-share plan, and an unbundled pricing plan. These options provide flexibility for traders to choose the most cost-effective plan based on their trading habits.

One potential drawback of TradeStation is its learning curve. The platform’s advanced features may be overwhelming for new users. However, TradeStation offers comprehensive educational resources to help users navigate the platform. These include tutorials, webinars, and a community forum where users can share strategies and tips.

In short, TradeStation has a lot to offer for traders of all levels. Its robust features, flexible pricing plans, and accessible mobile app make it a compelling alternative to NinjaTrader. While it may take some time to get the hang of it, the platform’s potential for customization and automation can significantly enhance your trading strategy.

2.3. TWS (Interactive Brokers)

As one of the most competitive platforms in the market, Interactive Brokers’ Trader WorkStation (TWS) provides traders with a comprehensive selection of tools and resources essential for trading. It offers a highly customizable interface that caters to individual trading preferences. With its robust functionality and wide range of features, it can accommodate various types of traders, from beginners to experienced professionals.

The heart of TWS is its advanced order management system, which allows traders to execute trades quickly and efficiently. It has over 100 order types and algorithms that provide traders with the flexibility to enter and exit trades based on their strategy. For instance, it allows traders to submit strategies involving multiple asset classes, like conditional orders, which are contingent on price movements of other securities.

Another standout feature of TWS is its comprehensive market data. Traders can access a broad range of trading tools, including real-time charts, news, market data, and analyses, all of which are essential in making informed trading decisions. Traders can also take advantage of the platform’s integration with third-party tools, such as Trade Ideas, for additional market insights.

Risk management is another area where TWS shines. The platform offers numerous risk management tools, such as real-time risk management and monitoring, to help traders manage their risk effectively. For example, users can set up alerts for market movements and view their portfolio’s risk in real-time.

When it comes to automated trading, TWS stands out with its API technology. Traders can automate their trading strategies by integrating their own custom-built software with TWS’ API, allowing them to execute trades automatically based on their trading parameters.

Finally, the educational resources offered by Interactive Brokers are top-notch. The platform has a comprehensive education center, including webinars, short videos, and courses, to help traders better understand market dynamics and improve their trading skills.

In terms of cons, TWS can be a bit daunting for new traders due to its advanced features and complex interface. The steep learning curve may require some time investment before becoming comfortable with the platform. However, once familiar with the system, the benefits of Interactive Brokers’ TWS are undeniable.

Overall, with its comprehensive trading tools, advanced order management, and sophisticated risk management capabilities, TWS provides a compelling alternative for those looking to branch out from NinjaTrader.

2.4. eSignal

Whether you’re a professional trader or just starting out in the world of trading, eSignal offers a comprehensive and highly customizable platform that stands as a formidable option for those looking at alternatives to NinjaTrader. eSignal has made a mark in the trading industry for its unique approach towards providing high-speed, quality market data and decision support tools.

One of the very distinct features of eSignal is its ability to make complex data easy to use and understand. The platform boasts a well-organized and intuitive interface that allows traders to analyze market trends, manage trades, and even backtest strategies without any undue hassle. This feature brings a level of simplicity that is rarely found among trading platforms, especially when dealing with complex data.

eSignal also comes with a highly flexible charting system that offers a wide range of technical indicators. The platform equips traders with over 100 indicators and studies, plus it allows you to create your own. This is a feature that would be appreciated by traders who rely heavily on technical analysis for their trade decisions.

Additionally, eSignal provides real-time market data from numerous global exchanges, including equities, futures, Forex, options, and ETFs. This extensive coverage ensures that traders have access to a multitude of trading opportunities across different markets. The reliable and speedy delivery of real-time data is a critical factor for traders who need to make swift and informed decisions.

Another highlight of the eSignal platform is its exceptional scripting language, EFS, which is used for creating custom studies and strategies. EFS is a JavaScript-based language, which is relatively easy to learn and use. This enables users to customize their analysis and trading processes to their particular style and preferences.

Lastly, eSignal also offers its users access to a network of third-party providers and brokers. This provides traders with a broader spectrum of trading opportunities and allows them to integrate their eSignal platform with their preferred broker for seamless trading.

In summary, eSignal presents a comprehensive trading solution that matches up well to the offerings of NinjaTrader. Its strong focus on high-quality data, a user-friendly interface, an advanced charting system, and extensive third-party integration makes it a strong contender in the trading platform arena, particularly for those seeking alternatives to NinjaTrader.

3. Choosing the Right Platform

Understanding your needs, level of experience, and trading style is crucial in selecting the right trading platform. Trading platforms are tools that facilitate the buying and selling of financial instruments. They differ in terms of functionality, user interface, available markets, and pricing.

Interactive Brokers is one alternative that is popular among experienced traders. It provides access to a wide range of global markets and offers advanced trading features such as algorithmic trading and risk management tools. The platform is highly customizable and can handle complex order types, making it suitable for sophisticated traders. However, it can be overwhelming for beginners due to its complexity.

eToro, on the other hand, is known for its social trading feature, which allows users to copy the trades of successful investors. Its user-friendly interface makes it accessible for novice traders. While it lacks the advanced features found in other platforms, its social trading feature is particularly attractive for those who wish to learn from more experienced traders.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used platforms due to their simplicity, flexibility, and extensive array of technical analysis tools. They support manual, automated, and copy trading. Both platforms are free to use, but the broker may charge for additional services or higher functionality.

ThinkorSwim, offered by TD Ameritrade, is another robust platform that caters to different types of traders. It offers a wide array of tools for technical analysis, strategy backtesting, and even paper trading (trading with virtual money for practice). Its easy-to-use interface, combined with advanced features, makes it a suitable choice for both beginners and experienced traders.

Consider factors like costs, ease of use, available markets, order types, analysis tools, and customer support when choosing a platform. Regardless of the platform you choose, always ensure that it is regulated by a reputable financial authority to guarantee the safety of your funds. Remember, the right platform for you will largely depend on your trading goals and style. Take advantage of demo accounts offered by these platforms to familiarize yourself with their features before committing to one.

3.1. Factors to Consider When Choosing a Trading Platform

Selecting a trading platform that aligns with your trading objectives and style takes more than just a flashy interface or a well-known brand name. Various factors need to be considered to ensure you make the best choice.

Firstly, review the types of securities the platform offers to trade. While some platforms cater to the needs of forex traders, others are more geared towards futures or equities. So, it’s essential to ensure that the platform you choose supports the types of trades you want to execute.

Secondly, consider the fees and commissions associated with the platform. Some platforms may charge a fee for every trade, while others might use a spread-based model. Be sure to understand these costs as they can significantly impact your profitability. It’s also essential to check for any hidden fees, such as those for withdrawals or inactivity.

Your third point of consideration should be the ease of use and usability of the platform. A trading platform that is difficult to navigate can cause unnecessary stress and possibly lead to costly errors. A good platform should be intuitive and easy to understand, even for beginners.

Platform stability should be your fourth consideration. A platform’s stability can make or break your trading experience, especially during peak trading hours. Ensure the platform can handle high volume trading without crashing or slowing down.

Customer service is another crucial factor. Even experienced traders can encounter issues or have questions, so it’s essential to choose a platform with a responsive and knowledgeable customer service team. This can be especially important if you’re new to trading, as you’ll likely need more support.

Consider platform features as well. Do they provide access to comprehensive charting tools, news feeds, and market data? Do they support automated trading?

Finally, check the platform’s security measures. Make sure the platform utilizes high-grade encryption to protect your personal and financial data. Additionally, look for platforms that are regulated by reputable bodies, as they are required to adhere to strict safety standards.

Compatibility with your hardware should not be overlooked. Some platforms are heavy and may not run smoothly on older computers. Others might not be compatible with certain operating systems.

Finally, consider community and social trading features. Some platforms allow traders to connect, share strategies, and even copy trades from successful traders. These features can be especially beneficial for new traders looking to learn and gain experience.

In conclusion, the ideal trading platform will be a balance of several factors tailored to your specific needs and trading style. Comparing different platforms based on these factors can help you choose the best platform for you.

3.2. Making the Switch – Transitioning from NinjaTrader to a New Platform

While NinjaTrader has been a long-standing favorite among traders, you might be considering an alternative platform for a variety of reasons. Perhaps you need more flexibility, or you’re interested in experimenting with different trading tools. Whatever your motivation, transitioning to a new platform can seem overwhelming at first, but with the right approach, you can make the switch as smooth as possible.

Step 1: Identifying Your Needs

First things first, you will need to identify what you want from a new trading platform. Do you need a wider range of analysis tools? Are you looking for better customer support? Whatever your needs may be, make a checklist. This will provide a clear picture of what you’re searching for and will inevitably guide your choice.

Step 2: Research

Next, it’s time to dive into some research. There are countless trading platforms out there, and choosing one blindly can lead to disappointment. Look for platforms that fulfill your identified needs. Remember to consider aspects like user interface, payment methods, and the speed of the platform.

Step 3: Test Driving

Once you’ve narrowed down your choices, it’s crucial to take the potential platforms for a test drive. Many platforms offer free trials or demo accounts. This is a great opportunity to assess the platform’s performance and see if it meets your expectations.

Step 4: Implementation

After you’ve chosen your new platform, it’s time for implementation. This can be a bit tricky, especially if you’ve been using NinjaTrader for a long time. It’s important to be patient with yourself during this process. Start by familiarizing yourself with the new platform’s interface and features.

Step 5: Training

Lastly, consider seeking training opportunities. Some platforms provide educational resources to help users get comfortable with their tools. This can be incredibly helpful when making the switch. Remember, it’s okay to take your time learning the ropes of your new platform. The important thing is to ensure that it serves your trading needs more proficiently, helping you achieve your financial goals.

Making a transition from NinjaTrader to a new platform can be a significant move. But with careful planning, thorough research, and a patient approach, you can smoothly navigate the process and position yourself for trading success in your new environment.